Having a business checking account is a must for most small businesses.

You’re able to keep your business and personal expenses separate, prep for taxes (no fun… but necessary!) and legitimately establish your business’s financial presence.

And thanks to the internet, entrepreneurs and small business owners have many options for choosing a business checking account.

You’re no longer limited to banks with offices in your immediate location.

But this offers a new challenge – it can be difficult to pare down all your options and choose THE ONE that’ll help you streamline your finances and grow your business.

That’s why I’ve pulled together a list of 17 different options for your business checking account including the pros and cons for each.

So you can choose the one that best fits your unique business needs.

Let’s dive in!

1. Kabbage Checking

American Express started Kabbage Checking to serve small businesses in the United States.

Kabbage Checking: The Key Stats

- Monthly Fee: $0

- Transaction Fee: None

- Minimum Opening Deposit: $0

- APY: 1.10% APY up to $100,000

Pros of Kabbage Checking

An interest earning account with no minimum balance requirements, an option not offered by many banks.

Cons of Kabbage Checking

Doesn’t have invoicing or accounting software integrations.

Who Should Use Kabbage Checking?

Small business owners in the U.S. who want to take advantage of interest earnings.

2. BlueVine Business Checking

BlueVine is a financial technology company that partners with Coastal Community Bank to provide banking services.

BlueVine Business Checking: The Key Stats

- Monthly Fee: $0

- Transaction Fee: None

- Minimum Opening Deposit: $0

- APY: 1.2% up to $100,000

Pros of BlueVine Business Checking

No fees and no minimum deposit. Interest on your money at 1.2% up to $100,000.

Cons of BlueVine Business Checking

There’s no evening or weekend customer service support.

Who Should Use BlueVine Business Checking?

Since BlueVine has limited customer support hours, this business checking account is best for entrepreneurs who don’t mind those limitations.

3. Chase Business Complete Checking

Chase is a well-known name in the banking industry and has a long-standing reputation for service.

Chase Business Complete Checking: The Key Stats

- Monthly Fee: $15, waivable under certain conditions

- Transaction Fee: None for the first 20 transactions

- Minimum Opening Deposit: $0

- APY: None

Pros of Chase Business Complete Checking

Part of a banking system with physical locations for those who prefer handling their banking needs in person.

Cons of Chase Business Complete Checking

The $15 monthly fee, though it’s waived if you have a daily balance of $2000 or meet other criteria.

Who Should Use Chase Business Complete Checking?

Best for entrepreneurs who prefer to use a physical bank branch for transactions.

4. Novo Business Checking

Novo is another Fintech company, and they partnered with Middlesex Federal Savings for the banking needs of their customers.

Novo Business Checking: The Key Stats

- Monthly Fee: $0

- Transaction Fee: None

- Minimum Opening Deposit: $50

- APY: None

Pros of Novo Business Checking

Novo Business Checking integrates with many business tools like Square, Stripe, Shopify, QuickBooks. These integrations make bookkeeping a lot easier.

Cons of Novo Business Checking

No options for cash deposits.

Who Should Use Novo Business Checking?

Small business owners who want a checking account that integrates with other software applications. Businesses that don’t have cash deposits.

5. LendingClub Tailored Checking

LendingClub is one of Forbes’ 50 most innovative companies. They were also named one of the best banks for real estate investors.

LendingClub Tailored Checking: The Key Stats

- Monthly Fee: $10 on accounts with less than $5000

- Transaction Fee: None

- Minimum Opening Deposit: $100

- APY: 0.10% on balances over $5000

Pros of LendingClub Tailored Checking

Currently, LendingClub is offering unlimited cash back on transactions made with a LendingClub debit card.

Cons of LendingClub Tailored Checking

You need an average balance of $5000 to waive the monthly fee and earn interest on your money.

Who Should Use LendingClub Tailored Checking?

Businesses that want to earn unlimited cash back on their debit card purchases.

6. Relay

Relay is an online banking and money management platform with a four and a half star rating (out of five) on Trustpilot.

Relay: The Key Stats

- Monthly Fee: $0

- Transaction Fee: None

- Minimum Opening Deposit: $0

- APY: None

Pros of Relay

No fees, and businesses can have up to 20 different checking accounts.

Cons of Relay

Relay doesn’t handle cash deposits. And they don’t offer phone support outside of regular business hours.

Who Should Use Relay?

Business owners who need multiple checking accounts. Or those that don’t have cash transactions.

7. Capital One

Capital One is another bank with brick-and-mortar locations. They’re in eight states and Washington D.C.

Capital One: The Key Stats

- Monthly Fee: $15, waived with balances of $2000

- Transaction Fee: None

- Minimum Opening Deposit: $250

- APY: None

Pros of Capital One

Unlimited, fee-free transactions and access to over 70,000 ATMs.

Cons of Capital One

You must visit a local branch to open your account. If you don’t live near one, you cannot open an account with Capital One.

Who Should Use Capital One?

Because you must visit a location to open an account, only businesses with local proximity to a Capital One location would be a good fit.

8. Bank of America

Bank of America has locations in 37 states and Washington, D.C., and offers two different business banking checking accounts.

Bank of America: The Key Stats

- Monthly Fee: $16, waived under varying conditions

- Transaction Fee: None

- Minimum Opening Deposit: $100

- APY: None

Pros of Bank of America

They have physical locations in multiple states, and their limits for cash deposits are higher than competitors.

Cons of Bank of America

The monthly fees they charge, as well as fees charged for incidental services like out-of-network ATM fees.

Who Should Use Bank of America?

Entrepreneurs who want access to a physical location and the ability to deposit large amounts of cash—up to $7500 free.

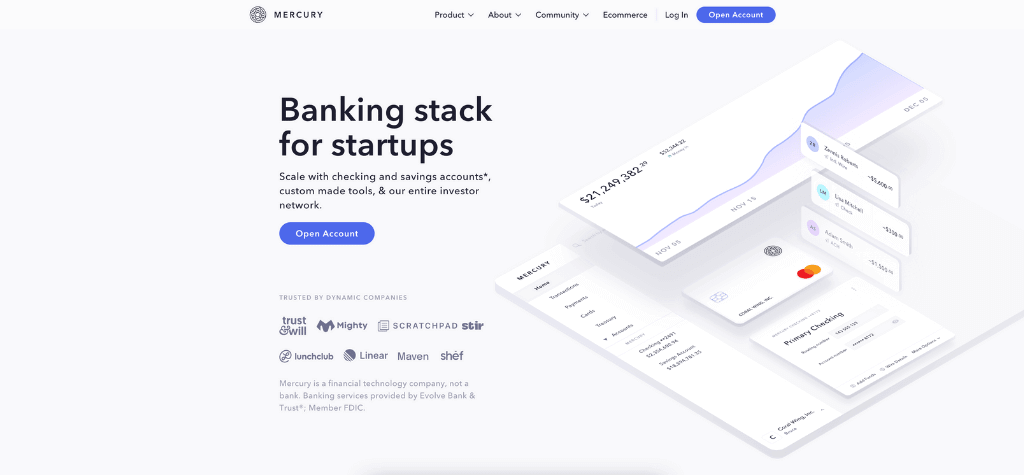

9. Mercury

Mercury is a banking platform built for startups and tech-focused businesses.

Mercury: The Key Stats

- Monthly Fee: $0

- Transaction Fee: None

- Minimum Opening Deposit: $0

- APY: None

Pros of Mercury

You have no fees and access to the API to customize your business banking experience.

Cons of Mercury

Accounts are not available to sole proprietors, and Mercury does not handle cash deposits.

Who Should Use Mercury?

Best for businesses in the startup and tech spaces and businesses that are not sole proprietorships.

10. U.S. Bank

U.S. Bank has physical locations across the US and multiple business checking account options, including one for nonprofits.

U.S. Bank: The Key Stats

- Monthly Fee: $0

- Transaction Fee: None for the first 125 transactions

- Minimum Opening Deposit: $0

- APY: None

Pros of U.S. Bank

There are no monthly fees or transaction fees, up to 125 transactions, and no minimum opening deposit.

Cons of U.S. Bank

They limit your business to just $2500 in cash deposits each month.

Who Should Use U.S. Bank?

Business owners who want a physical building they can walk into and get banking help and those businesses with low cash deposit requirements per month.

11. First Internet Bank

First Internet Bank is an online banking platform built specifically for small business owners.

First Internet Bank: The Key Stats

- Monthly Fee: $0

- Transaction Fee: None

- Minimum Opening Deposit: $100

- APY: 0.30% with an average balance of $10,000

Pros of First Internet Bank

With no fees, unlimited transactions, and an APY of 0.30%, First Internet is a solid option for small business owners. And they reimburse you for up to $10/month in ATM fees.

Cons of First Internet Bank

There are no physical locations and no ATMs for easy access to your account.

Who Should Use First Internet Bank?

Those business owners comfortable with online banking, who don’t need to visit a brick-and-mortar location and who want to earn interest on their business checking funds.

12. Lili

Lili is a mobile banking app created specifically for the business needs of freelancers and contractors.

Lili: The Key Stats

- Monthly Fee: $0

- Transaction Fee: None

- Minimum Opening Deposit: $0

- APY: None

Pros of Lili

Lili has a built-in tax tool that tracks and categorizes your expenses and a tax bucket that allows you to automatically set aside a percentage of your income for your taxes.

Cons of Lili

Lili is available only as a mobile app. There is no web access.

Who Should Use Lili?

Lili is best for freelancers and contractors who don’t mind doing all their banking via a mobile app.

13. NorthOne

NorthOne is an online banking option with customer service available by phone, chat or email. Customer service is handled by actual humans, not automated services.

NorthOne: The Key Stats

- Monthly Fee: $10

- Transaction Fee: None

- Minimum Opening Deposit: $50

- APY: None

Pros of NorthOne

Live support from real people. And NorthOne Envelopes so you can allocate funds and stay organized.

Cons of NorthOne

The $10 monthly fee with no options to waive it. While it’s a low fee, competitors offer ways to avoid the monthly charge.

Who Should Use NorthOne?

Best for businesses that like the envelope style of money management and don’t mind the $10 monthly service fee.

14. Axos

Axos’s Basic Business Checking is for small businesses with minimal banking needs.

Axos: The Key Stats

- Monthly Fee: $0

- Transaction Fee: None

- Minimum Opening Deposit: $0

- APY: None

Pros of Axos

No monthly fees and 24/7 customer support.

Cons of Axos

While Axos integrates with QuickBooks, they don’t offer third-party app integration for tools like invoicing software and payment processing platforms.

Who Should Use Axos?

Axos is best for small businesses that want to avoid fees and don’t mind business banking in its simplest form.

15. TD Business

TD Business calls itself America’s Most Convenient Bank® and says their customers are their priority.

TD Business: The Key Stats

- Monthly Fee: $10

- Transaction Fee: None

- Minimum Opening Deposit: $0

- APY: None

Pros of TD Business

TD Business offers 24/7 phone support, which is helpful for businesses in the side hustle phase and working evenings and weekends.

Cons of TD Business

There is no way to waive the $10 monthly service fee. TD Business also charges $3 per transaction with no reimbursement when using an out-of-network ATM.

Who Should Use TD Business?

Best for business owners who want 24/7 customer support.

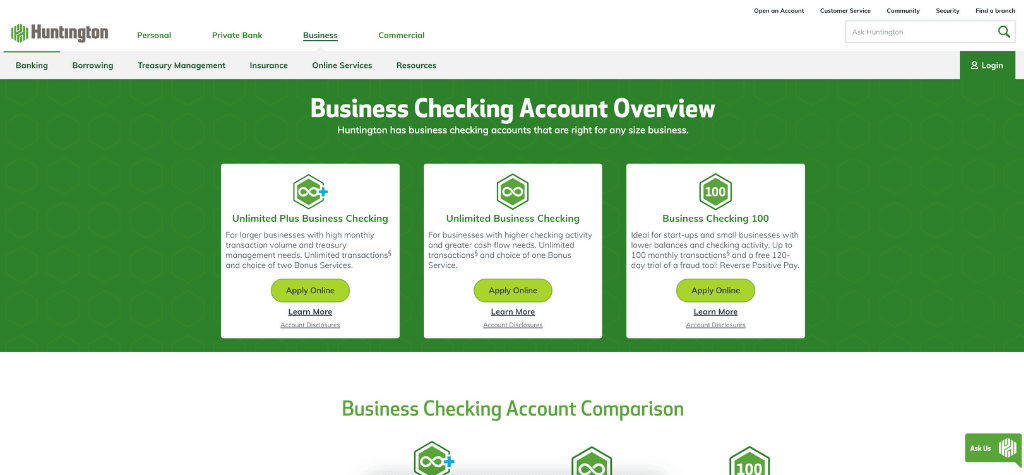

16. Huntington

Huntington is a regional bank in Columbus, OH, and has been around since 1866.

Huntington: The Key Stats

- Monthly Fee: $0

- Transaction Fee: None up to 100 transactions/month

- Minimum Opening Deposit: $0

- APY: None

Pros of Huntington

No overdraft fees if you’re not overdrawn by more than $50.

Cons of Huntington

If you have a lot of transactions each month, you’ll hit the 100 transaction limit pretty quickly. Then you’re charged 50 cents for each additional transaction.

Who Should Use Huntington?

As Huntington is not part of a national ATM network, you’ll want to live near a Huntington branch to avoid out-of-network ATM charges.

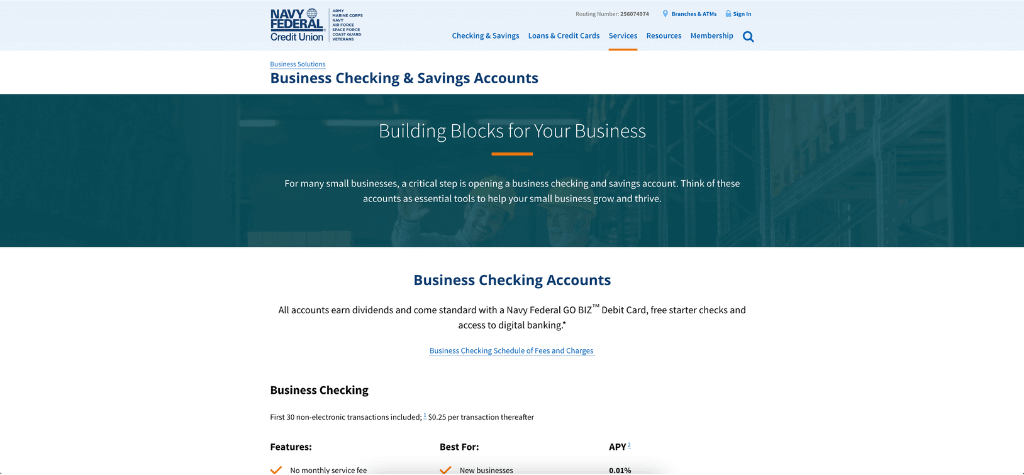

17. Navy Federal Credit Union

Navy Federal Credit Union membership is open to all current, retired and veteran armed forces members and their family members. It’s also available to the Department of Defense employees and their family members.

Navy Federal Credit Union: The Key Stats

- Monthly Fee: $0

- Transaction Fee: Electronic transactions are free. In-person transactions are free for the first 30, $0.25 for each additional transaction.

- Minimum Opening Deposit: $250 for sole proprietors, $255 for other legal entities

- APY: 0.01%

Pros of Navy Federal Credit Union

A free, interest-bearing checking account and no fees.

Cons of Navy Federal Credit Union

Limited eligibility. You must be a current or former member of the armed services, have worked for the DoD or be an eligible family member.

Who Should Use Navy Federal Credit Union?

Eligible members who handle most of their business transactions online.

What’s Your Favorite Business Bank Account?

There you have it – 17 ideas for your business checking account options.

Each bank has its own pros and cons and some options will be better for one business than another… so make sure you choose one that best fits your needs.

Tell me, which bank are you considering or do you already have one you love?

Let me know in the comments below and happy banking!

And if you’re looking for options for accepting payments (cha-ching!), check out my guide with 32 of the best PayPal alternatives.

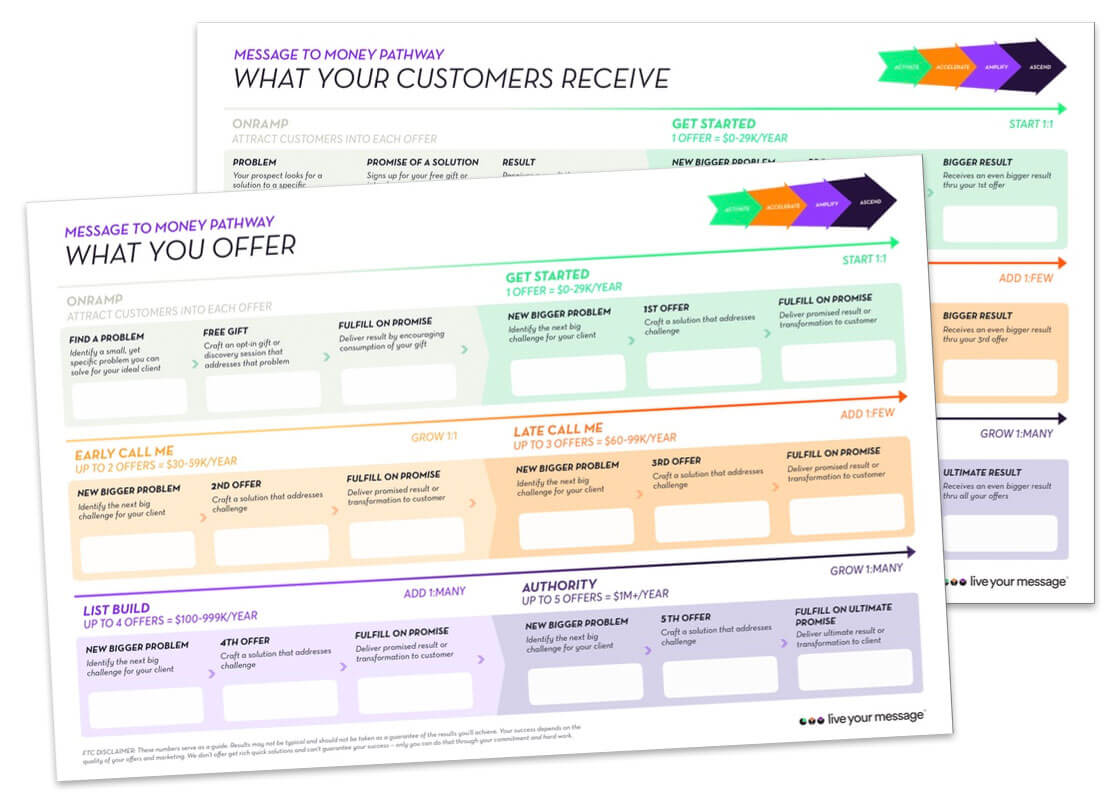

Ready to really grow your business and your impact? Then, join me for the ONLY business-building event where you’ll leave with a shorter to-do list than when you arrived!

I’ll be sharing exactly how to hone in on what to say, do and sell next in order to grow your business — with proven strategies that I’ve spent over a decade testing.

In fact, this is the ELEVENTH annual Live Your Message LIVE, and many students come back year after year — because the strategies keep working!

We’ll spend 3 days together virtually, working on your business and YOUR unique growth blueprint. As my premium business growth and networking event, tickets routinely go for $1,000 since the information is that valuable.

But today, your ticket is just $147! Grab your seat here.

You’ll ALSO receive your very own copy of my valuable Message to Money Pathway — your unique, highly-customized template that will guide you by the hand to your 6 or 7-figure business (regardless of where you’re starting from).

You’ll Zoom in “overwhelmed” and Zoom out with an exact roadmap for what to say, do and sell next to grow your business in 2023. Here’s the link again to grab your ticket.

See you virtually March 3-5, 2023 🙂

Leave a Comment